In Rajastan you can pay Commercial Tax online through e-Government Receipt Accounting System. e-GRAS is an online Government Receipts Accounting System. The departments which generate revenue for the Government are associated with eGRAS. To participate in e-GRAS, one has to click on new user creation and requires to fill up their credentials. Once the login ID is generated then one is authorised to use eGRAS for all types of challan submission. For one time transactions user can login by using user login from 'guest' and password 'guest'. For easy and rapid processing one must create ones required profile that would help the user to enter challan details at the blink of an eye. After submission of challan details, now website is transferred to selected bank website user can Use this site by using his internet facility. Bank will authenticate transaction and return to eGRAS port with transaction status. The steps to Pay Commercial Tax online in Rajasthan are explained here:

Step 1: Visit the Website of Commercial Taxes Department Government of Rajasthan

http://rajtax.gov.in/vatweb/Acts/actsMain.jsp?viewPageNo=18

The following Menu will open

Step 2: Click on e-GRAS

The following Menu will open

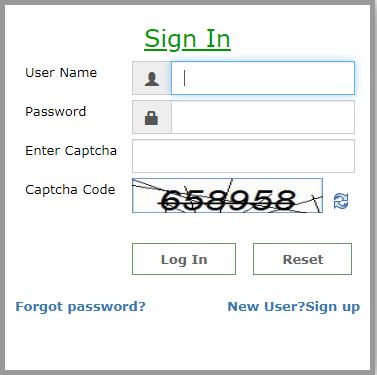

Step 1: Login

1- User Name

Enter user name. A username is a name that uniquely identifies someone

on

eGRAS portal.

2- Password

Enter the password. A password is used for authenticating a user on an

eGRAS

portal.

3- Capcha Code

Enter Capcha Code. It is interpreted by human and avoids any robotic

access to

websites.

4- Log In

Click Login, an authentication process that validates registered /

non-registered

user for further access to the eGRAS portal.

5- Reset

In order to change the entered information, click 'Reset'.

6- Forgot Password

In case, registered user does not remember his/her password.

7- New User Sign Up

Register with eGRAS portal.

Non Registered User

For non-registered user, login ID is 'guest' and password is also

'guest'. User submit challan after furnishing all required correct and

genuine information including nonmandatory as much as possible, online or

offline.

Login Form

User Name : guest

Password : guest

Capcha

Answer the question. This is used for security to avoid auto login process

or

programmed login process.

Log In

Click Login, an authentication process that validates user for further

access to

the eGRAS portal.

Reset

In order to change the entered information, click 'Reset'.

Guest Schema

Guest schema would be designed on each time when on guest login

Selection of Department

Department

You have to select the department for which payment to be made.

Back

If you click on Back button then you would reach on login page.

Select Budget Head

Department

Selected department name will display in the list.

To add budget heads in schema click on

To remove budget heads in schema click on

Submit

After selecting budget heads click on submit.

Reset

To discard all selected budget heads click on Reset

Registered user

For registered user, login ID and password are customised to the choice of

user on availability with eGRAS portal. User creates their multiple profiles

to cater challan form entries. After furnishing all required correct and

genuine information including non mandatory as much as possible, online or

offline.

Benefits / merits of Registering

Access to past history

Print facility of past transactions after logout.

Login Form

To register with eGRAS portal one should submit ones credentials online

using login form.

Every required information with a '*' is to be entered mandatory with

correct and reliable info.

1. Login Id

In this field you have to provide a unique id for login.

2. Check Availability

By clicking on this link, you can find whether the login id you have

provided exists already.

3. Password

In this field you have to provide a password. You have to choose the

password with the following policies:

- Password should contain at least 6 characters.

- Password should contain at least one numeric digit.

- Password should contain at least one capital letter.

- Password should contain at least one special character from!@#$*_-.

Confirm Password

In this field you have to provide the password that you entered in the

'password'

field.

First Name

In this field you have to provide your first name.

Last Name

In this field you have to provide your last name.

Gender

In this you have to select your gender.

DOB

In this field you have to provide your date of birth.

Marital Status

In this field you have to select your marital status whether married or

unmarried.

E-mail Id

In this field you have to provide your email id.

Address

In this field you have to provide your address (Off./Resi./Shop/Factory).

City

In this field you have to select your city from a given list.

State

In this field you have to select your state from a given list.

Country

In this field you have to select your country from a given list.

Mobile phone

In this field you have to provide your mobile number.

Pin code

In this field you have to provide your pin code.

TIN/AcctNO./VehicleNo/Taxid

In this field you have to provide your related ID/Number

Select your security Question

In this field you have to select a security question.

Answer

In this field you have to enter an answer to the security question.

Capcha

In this field you to provide the answer of the capcha code.

Submit

Enter all the required information then click on the submit button.

Home Screen

Login info

After successful login you can see Last successful/unsuccessful Login

information in the Login info.

Click here to show last 10 transactions

You can see your last 10 transaction details by clicking on the link click here to show last 10 transactions. You can hide the details of transactions by clicking on the link click here to hide.

Create Profile

You can create profile by clicking on the Create Profile link.

Continue

If you have already created a profile then select your profile from the

Profile List and click on the Continue button.

Create Profile

You can create profile by clicking on the Create Profile link.

Department

Selected department name will display in the list.

>>

To add budget heads in schema click on >>.

<<

To remove budget heads in schema click on <<.

Submit

After selecting budget heads click on submit.

Reset

To discard all selected budget heads click on Reset.

Budget heads

Select required budget heads from list of budget heads which belongs to

selected

department

Edit Profile

If you have already created a profile then select your profile from the

Profile List and click on the Edit.

Edit

You can edit details in your profile by clicking on the edit button.

NOTE: Rest same as create profile

Change Password

Old Password

You can change your password by providing old password in Old Password.

New Password

New Password in New Password.

Confirm New Password

Confirm your new password in the Confirm New Password.

Password Policy (?)

You can see the password policy by clicking on the Password Policy (?) link.

Submit

After providing details you have to click on Submit.

Reset

Password will be changed successfully. You can reset the all details by

clicking on

Reset.

View History

eGRAS has facilitated registered user to list their previous transactions.

View Challan Transaction

To list last 10 challans, click 'Click here to show last 10 transactions'

in future. To

view, detail of one particular challan click 'View'.

To submit same challan with minor changes click 'Repeat'.

Challan Processing

For easy and rapid processing one must create ones required profile that

would help the

user to enter challan details at the blink of an eye.

After submission of challan details, now website is transferred to selected bank website.

Bank will authenticate transaction and return to eGRAS port with transaction status.

One may take printout of challan in quintuplet in case of manual banking

[with cheque/DD] and flow orthodox procedure.

Location

You have to select location.

Office Name

You have to select Office Name.

PAN No. (If applicable)

You have to enter your PAN No.

Year (Period)

You have to select Year.

Purpose

List of budget heads from schema/profile would display here.

Total/Net Amount

You have to enter your Net Amount.

Amounts in words

Amount in words would be from server.

Payment details

Enter the remark or purpose of the challan you are submitting.

Type of payments

You have to select a payment type.

a. Manual: user will be depositing amount in cash/cheque/DD.

b. e-Banking: user will be using online bank transaction

Cheque/DD No.

Enter your Cheque / DD No.

Remitter's Name*

Enter user Remitter Name.

PIN*

Enter user area PIN code.

Address*

Enter user Address.

Profile Name

Name of selected profile will be display.

Department

Name of selected departed will be display.

Amount in Rs.

Enter budget head /purpose wise amount in rupees.

Deduct Commission

Enter commission, if applicable.

Name of Bank

Select name of bank branch of the related treasury to which selected office

belongs to.

TIN/Actt. No./Vehicle No./Taxid (if any)*

Enter TIN No/Actt. No./Taxid if applicable.

Town/City/District*

Enter Town/City/District.

Remarks (if any)

Enter Remarks (if any).

Submit

Click on submit after furnishing all required information.

Back

If you want to back on 'profile selection screen', click on 'Back'.

'*' Info would be flashed from login info form submitted by user.

Online Application

For online banking process, user has to have internet banking as well as

transaction

pass code.

Offline Application

For offline banking process, user select bank details while submitting

challan.

Banking

List of participating banks with eGRAS are as follows:

A. SBBJ

B. SBI

C. Union Bank

D. PNB

E. BOB

For online banking process, user has to have internet banking as well as transaction pass code.

For offline banking process, user has to have cheque/DD details while submitting challan.

Disclaimer: Information given here is to guide and help those who do not have knowledge of using online facility to Pay Commercial Taxes online or use online facility to check status of payment etc. We are not responsible for any mistake or error or loss of amount to the user. Our website is only guiding how to use online payment facility. All payments are being done through the website of Government Department and you may contact respective department for grievances if any. This website is to provide free information to users and we do not charge any amount from any user. Trade marks and copy rights are of respective website owners.

AP Pay Commercial Taxes challan online

Assam pay taxes, Government dues online

Chhattisgarh Pay Commercial Tax online

Goa pay taxes online through epayment

Gujarat Pay Tax online through epayment

Jharkhand pay tax online Professional, VAT

Karnataka Entry Tax payment online

Karnataka Professional tax Payment online

Karnataka Entertainment tax payment online

Kerala Pay Commercial Tax online

MP ePayment of Tax through MP treasury

Odisha online payment of taxes

Punjab epayment of commercial tax

Rajasthan Pay Commercial taxes online

Telangana online Payment of Taxes