E-verification of Income Tax Return using evc. How to e-verify income tax return online?

Online E-verification of income tax return through the website of Income Tax Department using evc.

You can e-verify the Income tax return filed online. You can also generate electronic verification code using the website of income tax department or through net banking account or Bank ATM or with the Aadhaar Card.

Steps to verify Income Tax Return using Electronic Verification Code.

Step 1. Visit the Income Tax Department online Portal https://www.incometax.gov.in/iec/foportal/

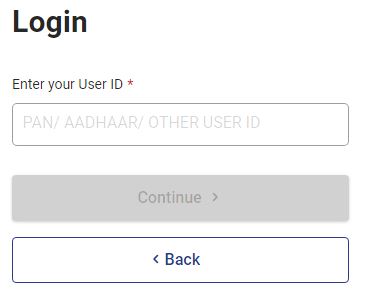

Step 2. If you are registered with the department website, Logon to e-filing application. If you are not registered, please follow the Steps to Register your PAN with Income Tax Department

Step 3. Enter your Login ID or PAN and Click on Continue

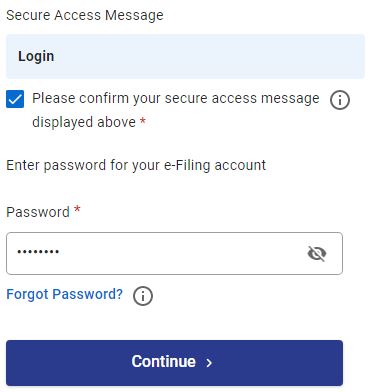

Step 4. Enter Password, click on please confirm your secure access message, and click on continue.

Now you are logged on to the website of Income Tax Department

Step 5. Click on e-File, Income Tax Returns and then everify return

Step 6. Chose everification method, enter OTP and click on submit

Disclaimer: We do not collect any information about or from the visitors of this website. Articles published here are only for information and guidance and not for any commercial purpose. We have tried our level best to keep maximum accuracy, however please confirm from relevant sources for maximum accuracy.